Tax Resolution

Get Relief From IRS Tax Problems

See if you qualify for IRS tax resolution programs.

Answer a few quick questions to get started.

Why You Shouldn’t Face the IRS Alone

IRS issues aren’t just financial — they’re stressful, confusing, and time-sensitive.

One wrong move can lead to penalties, interest, or enforced collection.

Protect Your Income

Garnishments and levies can happen fast. Professional representation helps protect your income.

Avoid Costly Mistakes

Every IRS notice requires a specific response. We help you avoid errors that could put you at risk.

Regain Control

You don’t have to guess your next step. Get clarity and a plan you can finally feel confident about.

Our Services

How we can help:

Whatever challenge you’re facing: debt, audits, liens, or levies.

We build a personalized plan to get you relief and protect what matters most.

IRS Tax Resolution

Offer in compromise

Wage Garnishment Release

IRS Audit Defense

Tax Lien Resolution

Prevent Levy & Seizure

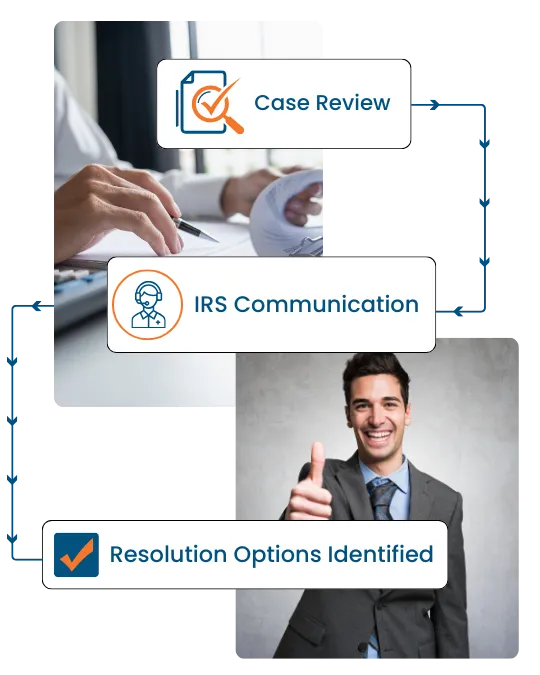

How It Works

A Clear Path Toward Resolution

Tax issues feel complicated, but the path forward doesn’t have to be.

Here’s how the process typically unfolds:

Start with a confidential consultation where your notices, timelines, and balances are reviewed.

From there, a tax professional communicates directly with the IRS on your behalf, reducing pressure while negotiating options that fit your reality.

Finally, you receive a custom resolution plan. Whether that means penalty reduction, a settlement, or stopping aggressive actions entirely.

Why Choose Us

Why People Trust Us With Their IRS Problems

When you’re dealing with the IRS, you need guidance you can trust. We combine expertise, honesty, and empathy to help you move forward with clarity and confidence.

Reassuring & Authoritative

We provide calm, confident guidance backed by real experience. You’re supported at every stage so you never have to face the IRS alone.

Honest & Transparent

No false promises. No confusion. Just clear explanations, realistic expectations, and straightforward communication throughout your case.

Empathetic & Solution-Focused

We listen, we understand your situation, and we build a plan designed for your real life; not a generic template.

Take Control of Your IRS Situation - Starting Today!

Every day you wait, penalties and interest grow.

A short conversation can change the direction of your case.

At Woodside Tax Resolution, we help individuals and businesses resolve IRS tax issues with clarity and confidence.

Contact us today for trusted, experienced IRS representation.

Quick Links

Quick Links

68-16 roosevelt ave, Woodside New York 11377

(646) 342-1908